What is an escrow account?

Did you know that “escrow” originates from the French term “escroue”? It means a scrap of paper signifying a deed that is held by a third party. An escrow account is a third party account who holds an asset or escrow money on behalf of two other parties that are in the process of completing a transaction. An escrow is used when there is uncertainty over whether one party or another will be able to fulfil their obligations.

Let me talk about a scenario. Let’s say you’re a buyer, and you ordered goods internationally, and you said you are only paying for them if they arrive in good condition. You can then put your payment into an escrow account first with an agent and the agent is in-charge of paying the goods to your seller if they are in good condition. So if you’re a buyer and are concerned whether your goods are in good condition, an escrow can help you. On the other hand, your seller won’t be worried as well as the escrow assures them about the payment. So it’s a win-win situation.

Ranges of transactions

There are many types of escrow transactions and listed below are some of them.

Real estate transactions and leasebacks. If you are a buyer of a real estate, you can carry out due diligence of any potential purchase and if you are dissatisfied, you can withdraw from the transaction without fear of recovering the deposit.

Construction projects. If you are worried about your employer or contractor's insolvency, an escrow account can help you.

Joint ventures. If you are part of an ongoing joint venture, an escrow account can be used for pooling of your funds and these can be released when your goals are met. Also, an escrow decreases the risk of a party not supplying funding.

Share sales. If you are concerned about the counter-party risk of doing shares, an escrow account or a third party can help you ease that worry by handling the waiting for completion of a corporate action.

Crypto currency exchange. When you want to make a large crypto purchase, an escrow can reduce your counter-party risk. You can put the crypto currency in an escrow then your seller can prove that the coins exist and reassure you that it will be settled in case there is a dispute.

Advantages of an escrow account

- Once you open an account, you can receive a discount on closing costs or interest rates.

- You will feel safe with your whole transaction since contracts with big amounts of money are handled by a third party that makes the transaction easier.

- Payments may vary and sometimes you are not required to pay all at once. The buyer can sometimes pay in instalments, and the timing depends on the insurance provider.

Disadvantages of an escrow account

- The funds sometimes get blocked when opening the escrow account. You will only earn interest on it if the transaction is completed.

- A lot of fluctuations may exist with interest rates after the first year, even if it is fixed.

Escrow account process

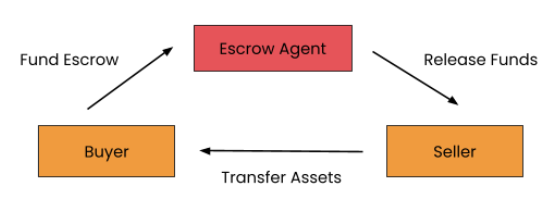

There are different types of an escrow account, but in this process, let’s focus on the buyer-seller relationship.

- The buyer and the seller enter into an agreement of purchasing the goods.

- The buyer signs a 3-way escrow agreement with the agent and the seller. The buyer deposits the funds into the escrow account.

- The manufacturer receives the order and is ready to produce the goods to be packed and delivered.

- The buyer, or the third party appointed, checks the quality of the goods. They then inform the agent if it is suitable.

- Once the payment is authorised by the buyer, the payment is then transferred to the seller or supplier’s account.

- The freight forwarder picks up the order to be sent to the airport to clear customs.

- The buyer clears the custom duties at the airport arrival and arranges everything that is needed after that.

What makes the escrow process inefficient?

Inspections. It can take time if not organised in a timely manner.

Documents. Locating and organising the required documents is the hardest part.

Slow and long escrow service. It is important to have an agent that is fast and always available to help.

Escrow account rules and requirements

Escrow cushion. This means you need to keep extra money into your account to cover unexpected payment fluctuations. For example, changes in taxes or insurance throughout the year.

Annual escrow statements and adjustments. Your loan provider will give you the details of your account history and activity for the year.

Escrow account disclosure. You can request your escrow account to be closed after it hits a specific percentage of loan-to-value. Typically, the loan-to-value ranges from 80% to 90%.

Conclusion

To conclude, an escrow account can be used for different purposes and is essential if you need financial protection. With an escrow account, you are guaranteed that your money is safe and sound. This is possible because there are financial professionals who will help and guide you through the process. Having these kinds of people you can trust with your finances is key, just like here Zetl, wherein clients from the APAC region go to our trusted team whenever they need help with funding.

Why choose us?

We are fast and flexible. Get paid the same day after signing up. Repay at your own convenience after 30 days.

Fully digital. Complete everything online — submit documents through our web app, and all contracts are executed digitally.

Confidential. Your client never needs to know about Zetl. All financing is fully confidential.

No personal guarantees. We believe business risk should be kept separate from personal liability.

Unlock funds by signing up on our website now! — www.zetl.com