Understanding Income Statements — What does a healthy Income Statement look like and how do you use it?

An Income Statement is one of three financial statements that report a specific aspect of a business’s financial position. What is the purpose of an Income Statement? How is it used? In this article, we will go over the basics of Income Statements and how to understand them.

An Income Statement is one of three financial statements that report a specific aspect of a business’s financial position. What is the purpose of an Income Statement? How is it used?

In this article, we will go over the basics of Income Statements and how to understand them.

What is an Income Statement?

To put it simply, an Income Statement is an overview of how much a company earned during a specific accounting period — it reports your net income.

The Income Statement, also known as a profit and loss statement, discloses (like its name says), the overall profit (or loss) of a company by grouping all revenues and subtracting all expenses from both operating and non-operating activities. If their net income is a positive number, the company reports a profit. If it is a negative one, it reports a loss.

The statement should include the company’s revenue, costs, gross profit, marketing, and administrative expenses, other non-operating expenses and income, taxes paid, and net profit in a coherent and intuitive manner.

In most cases, Income Statements are drawn up on a monthly basis for managers to check on the status of their operations. However, companies are free to determine an optimal financial period depending on their sector of activity (for example, they can be drawn up every 6 months). These Income Statements are then aggregated for quarterly and annual reports.

The difference between other financial statements

The Income Statement relates to the two other statements, the Balance Sheet and the Cash Flow Statement. While they report some of the same information, they have different purposes.

The Balance Sheet shows a company’s overall financial health and net worth by looking at its assets, liabilities, and equity at a specific point in time, whereas the Income Statement looks at your expenses and revenues over a period of time.

Generally speaking, the Income Statement can be interpreted as a performative measure. It provides valuable awareness of a company’s operations, the effectiveness of its management, under-performing sectors, and its performance relative to comparable businesses.

The Balance Sheet gives more of an overview of your company’s financial position. It tells you what your business owns and what it owes to others at a specific moment. Your net income appears in the line item called retained earnings. Your net income affects how much equity a business reports on the Balance Sheet.

The Cash Flow Statement, just like its name suggests, shows cash inflows and outflows during a period of time.

Key Information

- The Income Statement has many names: profit or loss statement, earnings report, statement of operations, consolidated statement of earnings, statement of financial performance.

- It is one of the three important financial statements (along with the Balance Sheet and Cash Flow Statement) that reveals the company’s financial performance.

- The Income Statement focuses on four key items — revenue, expenses, gains, and losses.

- In comparison to the other financial statements, the Income Statement is prepared on a regular basis (usually monthly or quarterly) and is essential to help make timely business decisions.

How does an Income Statement work?

Every Income Statement is based on the following formula:

Net Income = (Total Revenue + Gains) — (Total Expenses + Losses)

Because some of your financial statements draw from data reported on other statements, there’s a particular order you should follow when preparing them. To create a financial model, we need to start by drawing up the Income Statement as it requires the least amount of information compared to the Balance Sheet and Cash Flow Statement. Thus, the Income Statement is a predecessor to the other two core statements. These statements must be prepared in the following order:

- Income Statement

- Balance Sheet

- Cash Flow Statement

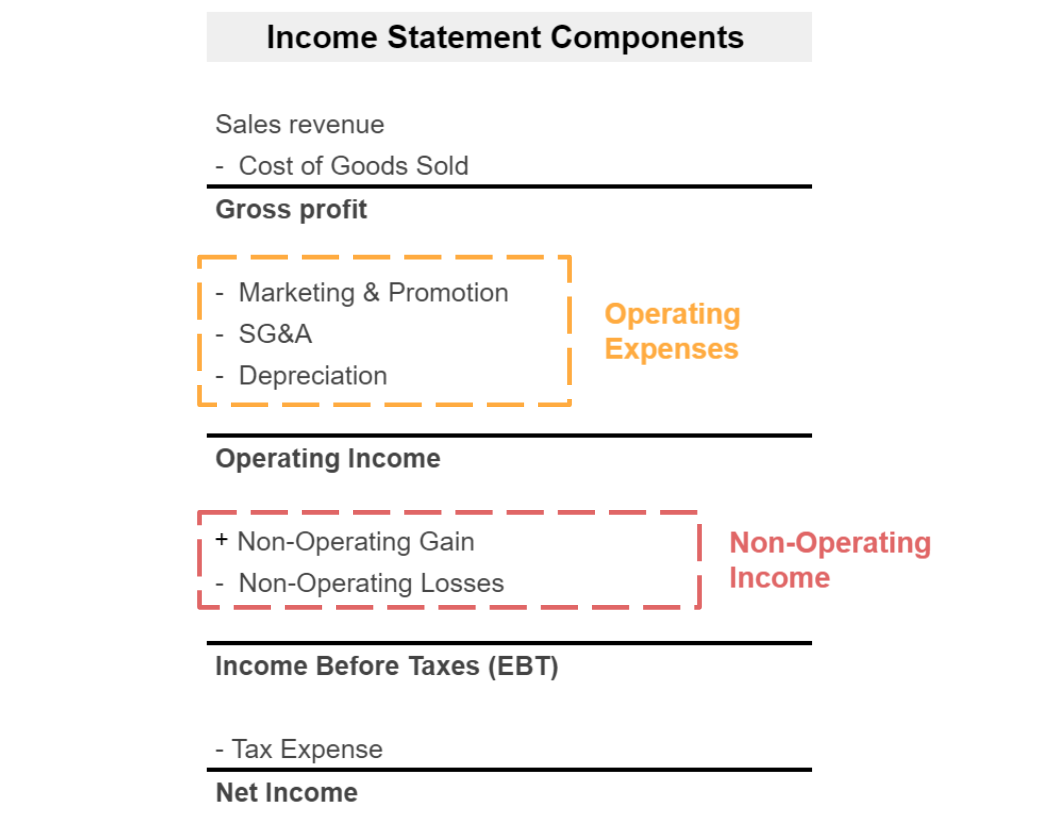

Main components of an Income Statement

Though Income Statements are generally identical and follow the same structure, there can be slight variations depending on the local regulatory requirements, the company’s scope of business, and the associated operating activities. Here are the essential components which an Income Statement must have:

Sales/Revenue

Revenue is the total income a company generates from its sales of goods or services. In accounting, the terms “sales” and “revenue” can, and often are, used interchangeably to mean the same thing. For most businesses, the majority of their revenues are derived from sales. However, companies may have several revenue streams that will add up and make the Net Sales.

For example, if you own a cake shop, your business’s operating revenue comes from selling the cakes. If you own a computer repair store, your business’s operating revenue is derived from providing that service.

There are two types of revenue, operating revenue and non-operating revenue. The former will appear on the top of the Income Statement. It is the revenue you receive from your business’s main activities (the sale of your product or service). The latter represent revenues realized through secondary, non-core business activities. Non-operating revenues will appear in the Other Income and Expenses section of the Income Statement.

Sales Revenue = Number of Unit Sold x Average Price per Unit

Cost of Goods Sold

After selling a good, it is important to account for the costs of the goods sold. Every piece of revenue from a product or a service has a certain type and amount of cost related to it.

These costs tend to increase when revenue or volume of sales increases.

Example of components in the cost of sales (cost of goods sold):

- Material

- Labor

- Overheads

Gross Profit

Your gross profit (or gross margin) is your Net Revenue minus the Cost of Goods Sold (Cost of revenue).

Gross Profit = Net Revenue - COGS

Some Income Statements do not show the Gross Profit as the cost of sales is grouped with all other expenses, which include marketing, technology, HR, general and administration (G&A), and other expenses.

Operating Costs

Operating costs do not directly increase as a result of the number of units sold. The cost might increase from year to year, but it is mainly driven by management decisions to allocate resources to strategic priorities.

Sales and Marketing Expenses

- Sales and marketing

- Advertising

- Promotions, trade shows, seminars, etc

General and Administrative (G&A) Expenses

- Finance

- Legal

- Rent and utilities

- Human resources, wages, etc.

Operating Income (Operating Profit or EBIT)

Your operating income is the first subtotal that you will find on a Balance Sheet. It is your net revenue minus all the costs incurred to sell your product or service. In other words, it is your Gross Profit minus Operating Costs.

Operating Income = Net Sales - Cost of Goods Sold - Operating Expenses

Or, EBIT = Gross Profit - Operating Expenses

Also known as Operating Profit, it is an indicator of a company’s efficiency. It shows your profitability before Interest and Tax, hence the name EBIT (Earnings Before Interest and Tax).

Though they mean the same thing, “Operating Profit” and “EBIT” can both appear as two separate line items on the Income Statement.

Income from Continuing Operations (Other Income and Expenses)

This section will display your non-operating revenues and expenses. Non-operating revenue is money earned from a side activity that is unrelated to your business’s day-to-day activities, like dividend income, interest, or profits from investments. If we compare it to operating revenue, non-operating revenue is more inconsistent. Sales are frequent, but you may not always make money from side activities.

Non-operating revenues and expenses are also called Gains and Losses respectively.

Example of Gains: Interest revenue, Sale of an asset/equipment, Return on investment, etc.

Example of Losses: Interest expense, Depreciation, Cost of a lawsuit, etc.

One-time earnings or expenses (such as restructuring or sale of an asset) are written in this section.

Earnings Before Tax (EBT)

Earnings Before Tax is a calculation of a company’s earnings before taxes are considered. The main difference between EBT and EBIT is that EBT takes into account your gains or loss from interests while EBIT does not.

EBT = Net Operating Income + Net Non-Operating Income

Or, EBT = Net Sales - Cost of Goods Sold (COGS), General and Administrative Expenses, Interest, Depreciation, and Other Expenses

Income Tax

This refers to the applicable tax on your pre-tax income.

Net Income

Net Income is calculated by deducting income taxes from pre-tax income. This final figure indicates whether the company has made a profit or a loss. The amount will go onto the Balance Sheet as retained earnings after deduction for dividends.

Net Income = Pre-tax Income — Income Tax

Earnings per Share (EPS)

In order to determine the EPS, the Net Income is divided by the weighted average shares outstanding.

EPS = Total Earnings / Outstanding Shares

What does an Income Statement look like?

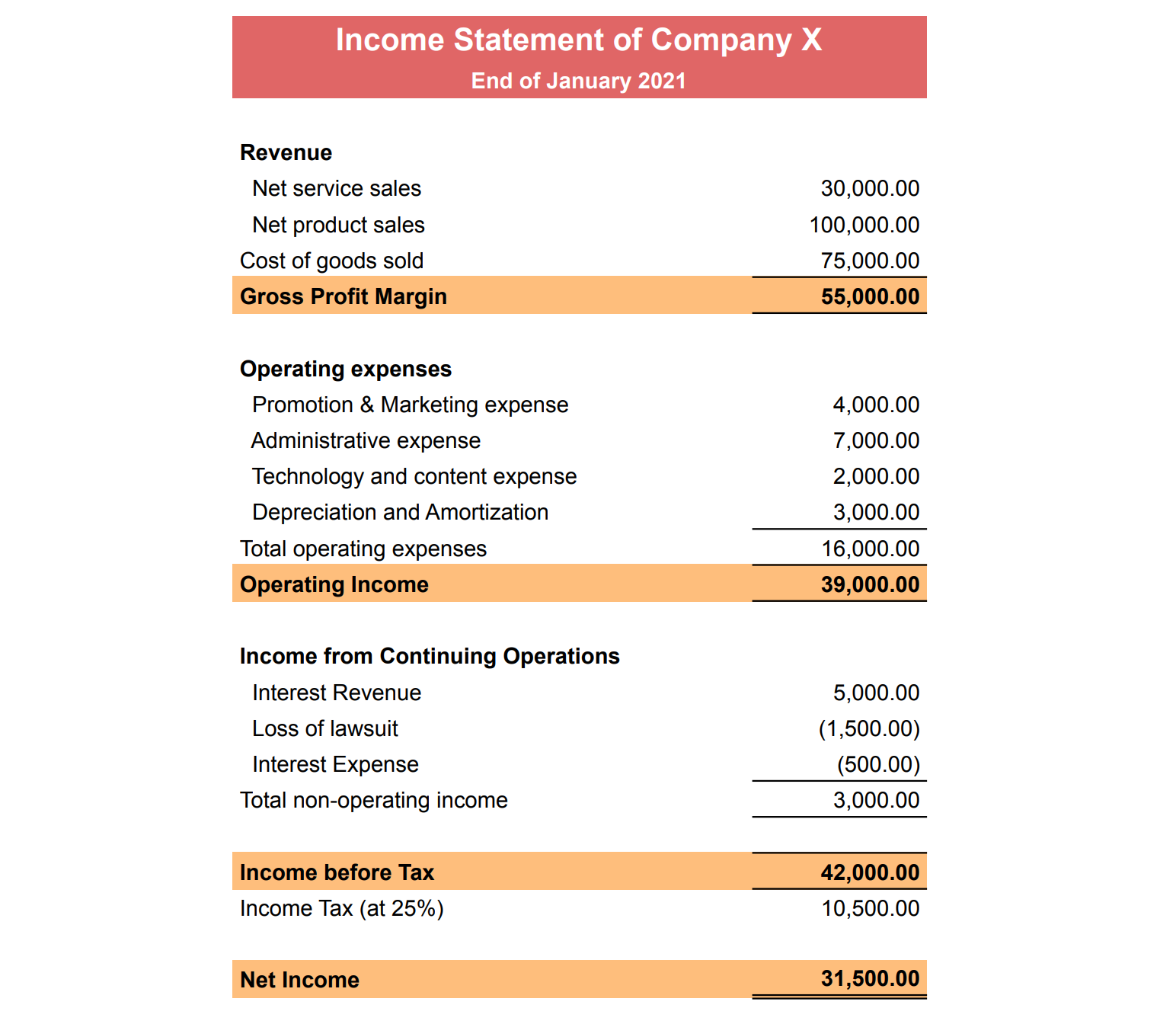

Here’s an example of what an Income Statement should look like:

Reading and evaluating an Income Statement

As our reference, we will be using the Income Statement presented above. Profitability is represented at four levels: gross, operating, pre-tax, and post-tax.

Starting at the top, company X has two revenue streams. The first one with the sale of a service, and the second, the sale of a product. The sum of these sales minus the cost of goods sold gives the Gross Profit Margin which amounts to $55,000.

The company spent money on various activities, to arrive at a total operating expense of $16,000. Subtracting the operating expenses from the gross profit margin will lead us to an operating income of $39,000 ($55,000 — $16,000). This figure also represents the Earnings Before Interest and Taxes (EBIT).

If you want to compare your business’s revenue from period to period, look at your operating income. This gives you more of an idea of whether your company is growing or declining. Non-operation revenue is not taken into account since it is irregular.

Everything that goes after operating income is not related to the ongoing operation of the business. We add them up to get a total non-operating income of $3,000.

The income before tax (EBT) is calculated by adding the operating income and non-operating income together ($39,000 + $3,000 = $42,000). Finally, we arrive at a net income of $31,500 by subtracting tax from the EBT ($42,000 — $10,500).

We can equally determine the Net Income with the general formula:

Net Income = (Revenue + Gains) — (Expenses + Losses)

Net Income = (130,000 + 5,000) — (91,000 + 12,500) = $31,500

Importance of the Income Statement

Though the main purpose of an Income Statement is to convey details about the profitability and business activities of the company, it is useful for much more:

1. It helps with decision making

As mentioned earlier, this statement provides detailed insights into the company’s internal operations, the effectiveness of its management, under-performing sectors, and its performance relative to comparable businesses. Such a report can be prepared at the department or segment level to gain a deeper understanding of the management of different areas in a company. These interim reports can remain internal to the firm. This information helps managers make decisions like pushing sales, increasing production capacity, expanding to new geographies, or closing down an underperforming department or line of product. In addition, competitors can equally use them to get a sense of how a successful company allocates its financial resources and focus on areas such as R&D spending.

2. It helps pinpoint expenses

The statement highlights the expenses and unexpected expenditures sustained by the company. It shows any areas which are over or under budget. As a small business grows, it may find its expenses soaring. New expenses may involve hiring new workers, R&D, or promoting the business.

3. It gives an overall analysis of the company

This statement displays an overview of the company. It helps investors decide which firm they want to invest in. For banks and other financial institutions, this document helps gauge the financial health of a company to decide whether the business is loan-worthy.

Income Statement and Balance Sheet

The Income Statement and Balance Sheet are closely related. We need both of them to enable double-entry bookkeeping. In a single transaction, two entries are always recorded: one on the Income Statement, and one on the Balance Sheet.

What goes into the sales and expenses in the Income Statement will affect assets and liabilities on the Balance Sheet. For instance, when a company records a sale, it will increase assets or decrease liability on the Balance Sheet. When an expense is recorded, assets will decrease or liabilities will increase.

Here’s a helpful illustration inspired by dummies.com which shows the relationship between these two financial statements.

Main Differences

1. Components reported - The Income Statement reports revenues, expenses, and profit or loss. The Balance Sheet reports assets, liabilities, and shareholder equity.

2. Timing - The Income Statement reports the financial performance of a company over a specific period of time (usually a month, a quarter, or a year). On the other hand, the Balance Sheet outlines the financial activity on a specific date.

3. Metric - The line items on the Income Statement are compared to the sales figure to find your company’s gross margin, operating income, and net income, as percentages. Information on the Balance Sheet can be used to understand the liquidity of your business.

Visual Recap

Conclusion

The Income Statement is one of the three major financial statements that show a company’s expense, income, gains, and losses, which enables us to calculate the net profit or loss for that time period. It is a valuable source of information about the key inputs for a profitable company. Produced on a regular basis, the Income Statement gives frequent updates. This enables business owners to make timely decisions to ensure the business is on good financial footing.