How to Avoid Financing Costs so the Smaller Fish Gets to Eat Too

Borrowing, the word used to scare SMEs in the past who would prefer balance sheets cleaner than linen sheets. New-age SMEs understand that while acting conservatively can sustain their business, leverage is often more important for growth and development. At The pace at which businesses in the APAC are evolving, SMEs need to use leverage in the best way possible. Like any story that is too good to be true, financing has its caveats too and today we will go through 6 financing costs that you can avoid.

1. Setup Fees

There is no free meal in this world, so when you walk into a bank to set up an overdraft or a revolving credit line the setup costs start to add up. Setup fees or general banking fees contribute to a big chunk of the revenue of a bank.

From time to time, banks are willing to waive setup costs if you are an existing customer but good luck to the new appliers. If you compare different banks and their setup, maintenance, or several other costs, you conclude how much the costs can differ from each other and why it is a major cost to avoid or at least minimize. How to avoid this cost? Well, keep reading till the end of this blog to find out!

2. Overdue charges

We can all make peace with overdue charges because unlike all other costs that banks tend to charge us, we have some control over this certain cost. Do some banks charge ridiculous interests on overdue? Yes. But one thing to keep in mind is that, unlike other charges, overdue charges can be easily averted if you have the money to pay back that is. By keeping track of the dates of your debt maturities on a spreadsheet you can easily track when to repay particular debts and to your luck, most debts have fixed repayment structures.

3. Personal Guarantees

We have all lent money to friends and families and there are occasions when we don’t get paid back We wish if only someone had taken responsibility.

Now try to imagine a bank where their main revenue generation is via lending deposits and collecting interests. A personal guarantee makes a lot of sense but now let’s look at the other side of the same story when a CEO of a company has to be a guarantor of a loan his company is taking.

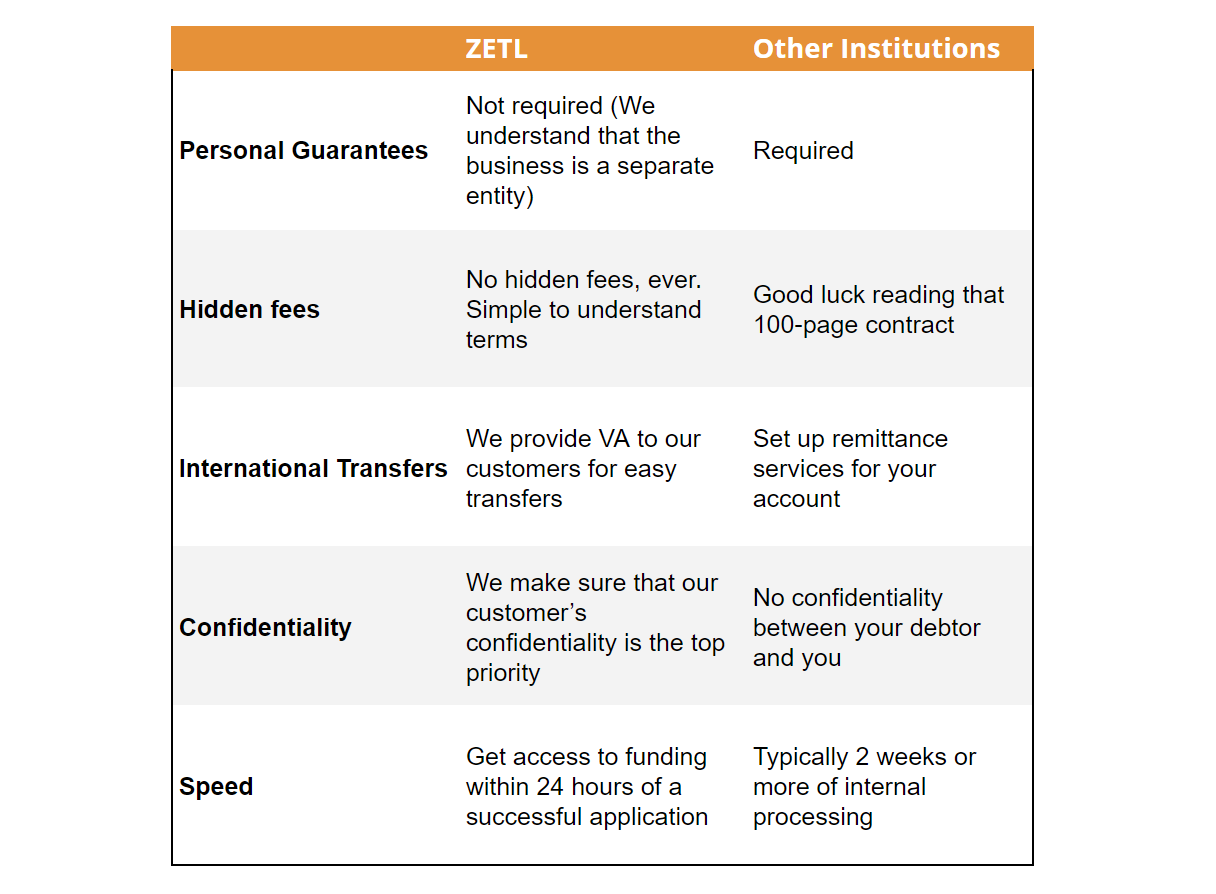

We remember hearing that the CEO and the business are 2 separate entities so the CEO should not have to be on the line. To avoid this, some insurance companies provide personal guarantee insurances but the best way to avoid this cost is to choose a bank or service that doesn’t require personal guarantees.

4. Reviewing Limit Increase

Let’s hope that your business is bustling, your profit margins are growing and your customer base is getting larger. What is the next logical step? Expand!

To go through an expansion, a capital restructuring might be needed. you will contact your relationship manager and talk about increasing your facility limits for your financing method. However, There’s a catch… your relationship manager usually charges a commission for arranging this review. The best way to avoid this cost is to make sure that you select a service with no middlemen, although limited there are companies making financing easier for SMEs!

5. Higher Interests

Let’s face it, SMEs have the hardest times obtaining any financing mostly because of their limited revenue streams or the fact that they are very asset-light initially. So to compensate for the credit risk associated with lending, banks tend to charge higher interest to enjoy that risk premium.

To avoid higher interests, SMEs need to look at new ways of financing their business. This can be done through either finding investors, but that comes at the cost of giving away equity, or businesses can look into leverage

6. Time

The most important thing that comes to mind when thinking of costs to avoid when financing is time. Opportunity cost is something associated with missed opportunities. Let’s say you have two options; a and b, when you choose either option over the other, the option left behind becomes your opportunity cost.

So when you as an entrepreneur talk to a bank about financing options it becomes a tedious process that can take up to 2 weeks for you to successfully unlock funds. As a business, when you don’t have access to funds for 2 weeks the opportunity costs start to add up as you just have to stay idle till banks clear financing. To avoid this cost you can select a service that understands the difficulties that SMEs face and shapes their services around those problems.

Conclusion

So these are the 6 financial costs that are avoidable for young businesses so that they can maximize their potential growth without any roadblocks. The most important part for a business is to stay vigilant and make sure that their banks, relationship managers, or financiers are not piling on unnecessary costs that are just slowing down the business.

About Zetl

Now, it would be unfair for us to tell you the costs to avoid without the one-stop solution! Welcome to Zetl, we help SMEs build their business by providing a variety of funding solutions. We help you unlock working capital in less than 24 hours so you can focus on what truly matters — growing your business.

Why Zetl?

Why are we the best at what we do? The founders at Zetl have had first-hand experience with the tedious process of going to banks for financing needs and then realizing how long and expensive it can be!

Sign up for ZETL

To sign up for ZETL, you can visit our website https://www.zetl.com

We get it, decisions like this take time! So you can shoot your queries at us at: [email protected]

— Written By Simranjit Singh