Everything You Need to Know About Corporate Credit Ratings

A corporate credit rating is a quantified assessment of a company’s creditworthiness, which shows investors the likelihood of a company defaulting on its debt obligations or outstanding bonds. In other words, a credit rating is an opinion on the ability of a business to repay its debt.

What is a credit rating?

A corporate credit rating is a quantified assessment of a company’s creditworthiness, which shows investors the likelihood of a company defaulting on its debt obligations or outstanding bonds. In other words, a credit rating is an opinion on the ability of a business to repay its debt.

Who uses credit ratings?

- Investors — Investors take into consideration credit ratings to manage their portfolios.

- Intermediaries — Ratings allow intermediaries to understand an entity’s credit profile.

- Businesses and financial institutions — A credit rating is generally required to acquire public bonds and certain loan structures. A good credit score can be used to a company’s advantage by making them more favorable to a broader range of debt products.

Who rates the companies?

Corporate credit ratings are issued by rating agencies. Although others exist, there are three main independent rating agencies: Standard & Poor’s (S&P), Moody’s Investor Services (Moody’s), and Fitch IBCA (Fitch). While all these agencies specialize in evaluating credit risk, some specialize in a geographical region or industry (regional and niche rating agencies).

Credit rating agencies are private companies. A fee is charged to the entity that is seeking to receive a grade, or to the entity that wishes to use and analyze the rating. The scores are given in the form of a detailed report and are usually found on the rating agency’s website. These grades are based on the analysis of the financial history of borrowing or lending and a company's creditworthiness.

Most public companies have a credit rating, and their reports are disclosed to the public.

Credit rating scale

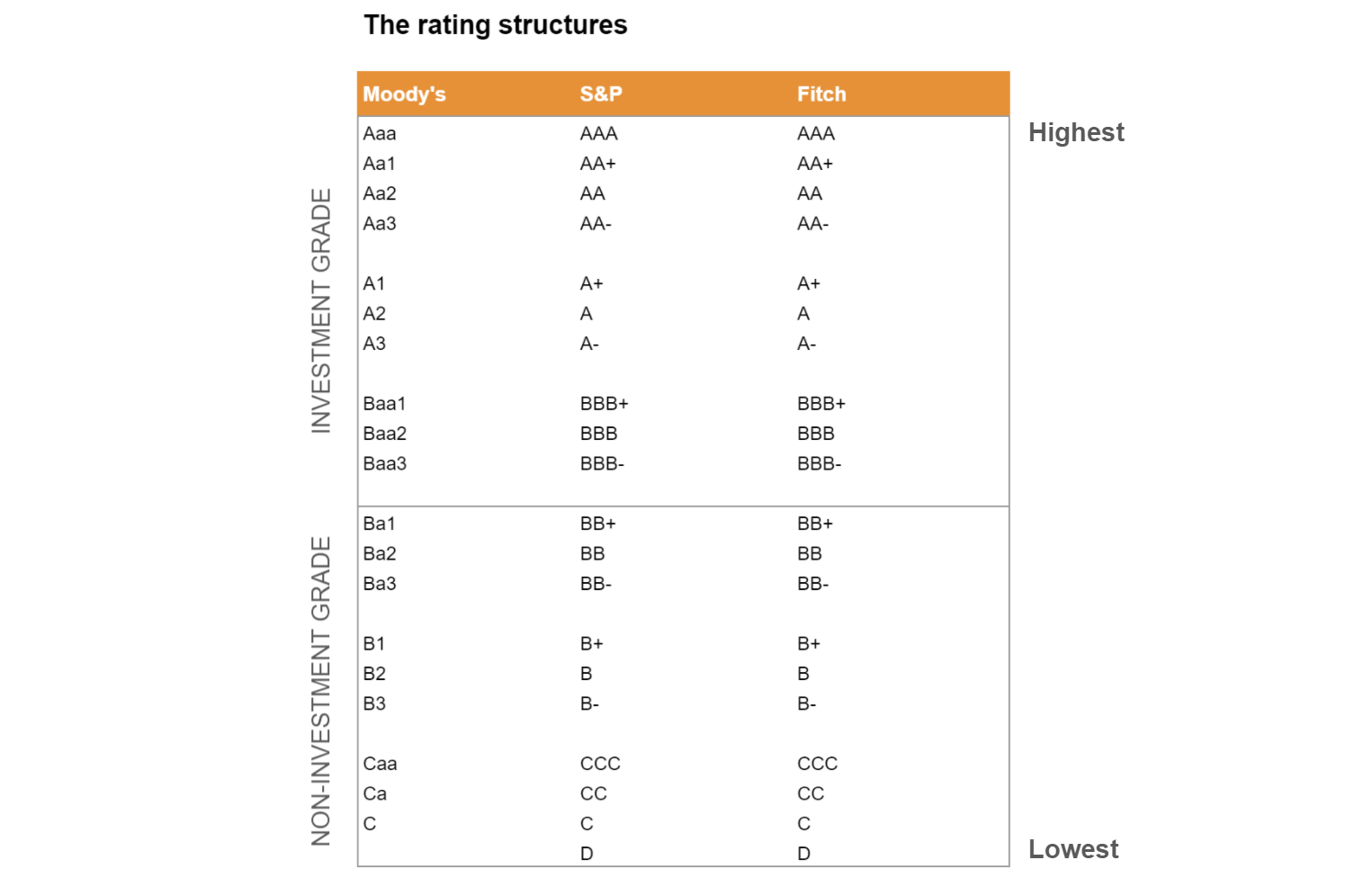

Each agency uses its own methodology in measuring creditworthiness and uses a specific rating scale to publish its ratings opinions. Though there is no standard scale, an equivalence can be found for each opinion. Generally, the ratings are represented as letter grades that range from ‘AAA’ to ‘D’ to express the agency’s opinion of the relative level of credit risk.

A company with no debt will not have a credit rating — but will have a good credit score

A credit score is also an investment grade for municipal or corporate bonds.

For instance, a high credit score, “AAA” which is the highest score, means the company has the highest credit quality. A rating in this category means that the company has a high capacity to repay its bond. “A” scores are given to companies deemed stable since they possess a great capacity for repaying their financial commitments. However, they may encounter some challenges during declining economic periods.

“BBB” ratings are the bottom tier of the investment grades and are still considered satisfactory. Everything below, (“BB”, “C” and “D”) is deemed as speculative or “junk”.

Important considerations

A good credit score is not a guarantee that a company will repay its obligations. It is important to remember that these are just opinions of agencies, not facts. In addition to this, credit scores are relative within a universe of credit risk.

“A corporate bond that is rated ‘AA’ is viewed by the rating agency as having a higher credit quality than a corporate bond with a ‘BBB’ rating. But the ‘AA’ rating isn’t a guarantee that it will not default, only that, in the agency’s opinion, it is less likely to default than the ‘BBB’ bond.”

— S&P Global, Guide to Credit Ratings

Rating Methodologies

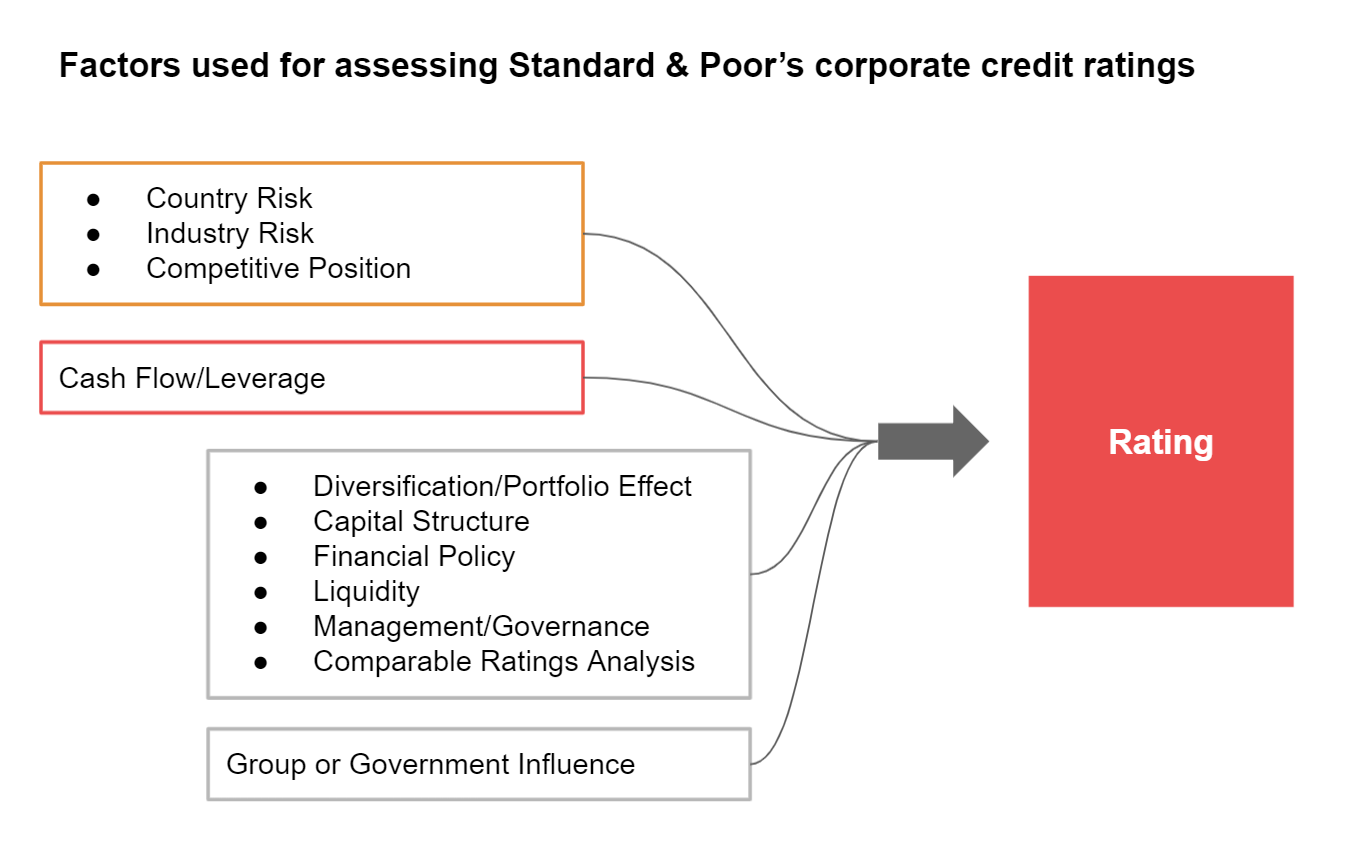

A rating methodology is a process or method an agency follows to calculate risk. While each agency is independent of one another with their process, they use a broadly similar rating methodology. We can draw up two main aspects that agencies look for:

- Business Risk: Agencies will evaluate the strengths and weaknesses of the operations of the entity by looking at their business strategy, market position, competition. In addition to this, contextual criteria are also considered such as changes in the industry and political stability of the country.

- Financial Risk: Here, Agencies evaluate the financial flexibility of the entity by looking at quantitative data such as profitability, operations cash flow, liquidity, growth expectations, funding diversity, and financial forecasts. Two important ratios are also examined:

- Leverage: Leverage is just another word for debt. Calculating the leverage ratio (also known as the gearing ratio) of a company will tell you how much debt they are already exposed to. A higher ratio implies more debt and therefore a higher default risk

- EBITDA: A company’s earning before interest, taxes, depreciation, and amortization is another key metric that is identified. A high default risk stands in correlation with the company's level of debt relative to its EBITDA.

Why credit ratings are useful

Credit ratings are important because they illustrate the risk associated with an entity’s solvency. Therefore, these rating agencies play a central role in financial markets.

What to remember

- A credit rating is an opinion of a credit rating agency that assesses a company’s ability to pay its creditors.

- The three main rating agencies are Moody’s, S&P, and Fitch.

- “AAA” is the highest credit quality while C or D (depending on the agency) is the lowest or junk quality.

- A credit rating is a major factor in investment decisions. It helps investors gauge the risk related to buying a certain bond.

- With a relatively good rating, businesses can access a wider range of lenders and debt products. Thus, it can be a great tool to support and accelerate the growth of a company.

About Zetl

Here at Zetl, we help SMEs build their business by providing a variety of funding solutions. Our proprietary credit scoring process uses a variety of inputs about your business and accounts receivables to provide you with a financing fee that reflects the quality of your corporate clients. We help you unlock working capital in less than 24 hours so you can focus on what truly matters — growing your business.

Why choose us?

We are fast and flexible. Get paid the same day after signing up. Repay at your convenience after 30 days.

Fully digital. Complete everything online — submit documents through our web app, and all contracts are executed digitally.

Confidential. Your client never needs to know about Zetl. All financing is fully confidential.

No personal guarantees. We believe business risk should be kept separate from personal liability.

Unlock funds by signing up on our website now! — www.zetl.com