Accounts Receivable Management — What is it and how should we prioritise it?

For most small to medium-sized businesses, one of the biggest challenges of running a business is billing. Over half of all bankruptcies can be attributed to poor receivables management. Here, we will dive deep into what accounts receivable are and how AR management can benefit your business.

What are Accounts Receivables?

Accounts receivable (AR) represent the amount of money that customers owe to a business for goods or services received that have not yet been paid. They are listed as current assets. ARs are created when a customer purchases on credit. The company delivers the goods or service immediately, sends an invoice to the customer, and gets paid typically a few weeks after.

Accounts receivable are used as part of accrual basis accounting.

Under cash basis accounting, there are no accounts receivable. A transaction doesn’t count as a sale until the cash is received or paid out.

Where you can find them

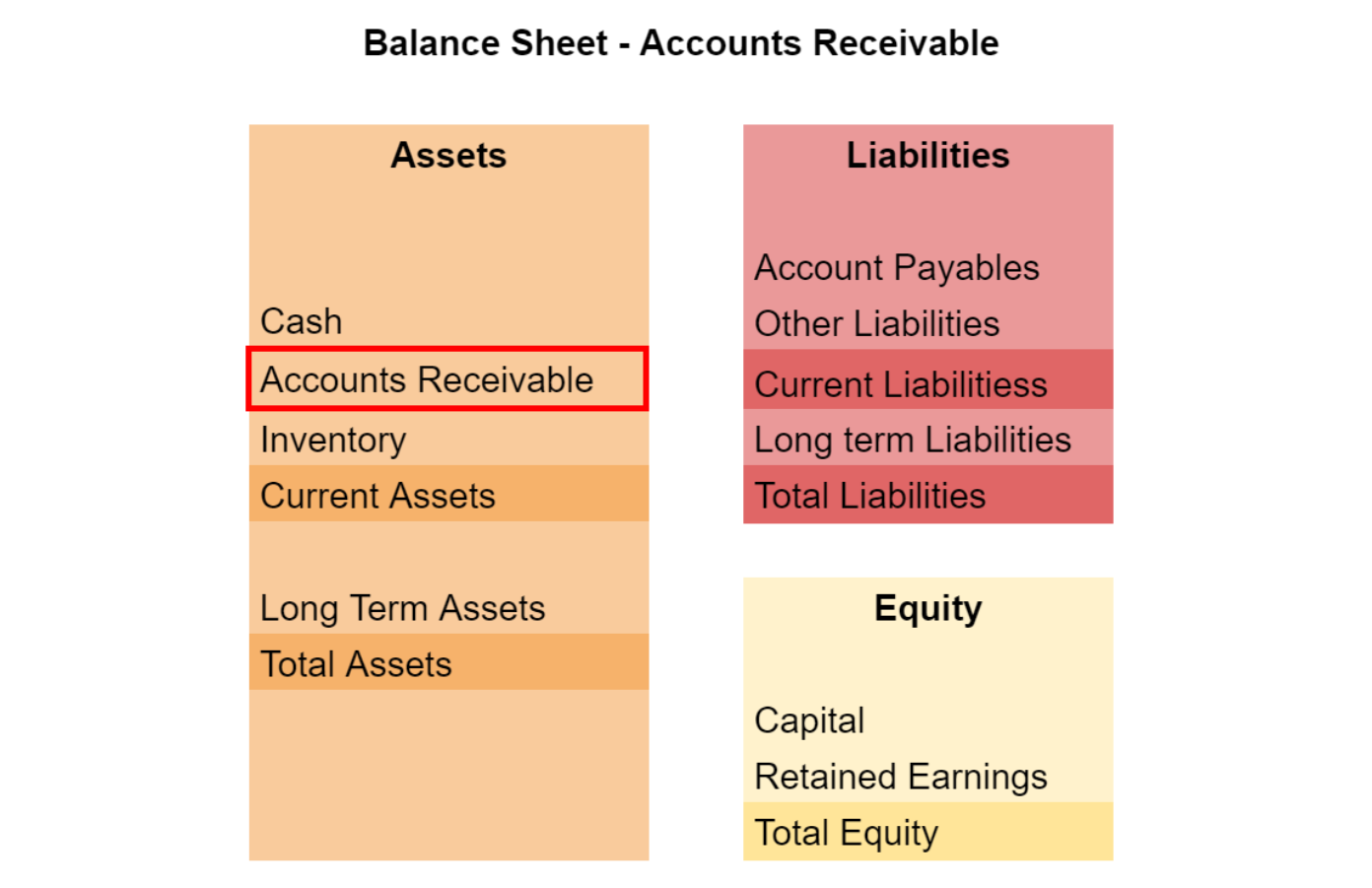

Accounts receivable are found in the balance sheet under the ‘current assets’ as they add value to the firm and represent money coming in (as a future cash payment).

What if customers don’t pay?

When it is clear that a client cannot or won’t pay (due to bankruptcy, financial problems, etc), the amount has to be written off as a bad debt expense.

Accounts Receivable vs Accounts Payable

Accounts payable are the opposite of accounts receivable. Instead of representing money a client owes to you, Accounts payables represent money you owe to another business. Accounts receivable are asset accounts, while accounts payable are liability accounts.

The importance of Accounts Receivables

Accounts receivable are a vital part of a business’s cash flow. For many SMEs, receivables make up the majority of their working capital. Even though a business may experience steady growth and sales, poor AR management will cause cash flow issues, which could lead to the company’s downfall.

According to a report by Quickbooks, almost one-third of businesses are unable to pay vendors, themselves or their employees, or are unable to make loan payments. Businesses are forced to turn down sales and opportunities due to insufficient cash flow.

Account Receivable Turnover ratio

To keep track of late payments, we use a helpful tool called the account receivable turnover ratio. It measures how often a business collects its average accounts receivable. The higher the ratio, the faster your customers are paying you.

The formula:

Accounts Receivable Turnover Ratio = Total Net Credit Sales / Average Accounts Receivable

Receivable turnover in days formula:

Receivable turnover in days = 365 / Receivable Turnover Ratio

For example,

On January 1, 2020, company X had total accounts receivable of $4500. At the end of the year, Dec 31, 2020, its total accounts receivable was $2,500. The firm also had a total net sales of $80,000 for 2020.

First, we need to calculate the average accounts receivable of company X. For that year, we add the beginning and ending accounts receivable amounts and divide them by two:

$4500 + $2,500 / 2 = $3,500

To get the accounts receivable turnover ratio, we divide net sales ($80,000) by the average accounts receivable ($3,500):

$80,000 / $3,500 = 22.8

Company X has an accounts receivable turnover ratio of 22.8, which is pretty good. The higher this ratio is, the faster your customers are paying you. With a ratio of 22.8, it takes an average of 16 days for customers to pay their bills in 2020.

We find this figure by calculating the average sales collection period (the average time it takes for your customers to pay you). We divide 365 by the accounts receivable turnover ratio (22.8):

365 days / 22.8 = 16 days

A good ratio would range from 10 up to 30.

Accounts receivable management

Accounts receivable management is all about ensuring that customers pay their invoices. It helps prevent overdue payments or non-payment.

Good AR management directly contributes to a company’s profit because it reduces bad debt. The company has higher liquidity and a better cash flow to ensure its operations. In addition to this, good receivable management can be a tool to build strong relationships with your clients.

5 tips to improve AR Management

1. Prioritize billing and invoicing

Cash flow is a fundamental part of a business, and getting into the habit of invoicing as soon as the work is finished is only beneficial. Consistency is key to ensure on-time and regular payments. Sending invoices early will likely make clients pay on time as it is still fresh on his or her mind.

2. Communicate

A big part of account receivable management is communicating with the customers. It often happens for a customer to forget about payment. We recommend staying in touch by periodically sending out reminders. Taking the time to call or sending an email to clients will increase your receivable turnover rate compared to sending an invoice and never following up.

3. Create an AR aging report

Having a lot of customers is great, but you can easily lose track of invoices, payments, and customers. Creating a system like an accounts receivable aging schedule will help you save time and effort by organizing pending payments.\

This system allows you to oversee which clients are late in their payments and the amount due.

4. Make it easy for customers to pay

Making it easy for customers to pay invoices will also increase the likelihood of on-time payments. In addition to direct deposit and cash payments, consider broadening your range of payment methods. Different payment methods like mobile payments, bank transfers, and E-Wallets are increasingly popular and more convenient for your client.

5. Be clear about payment deadlines

Many businesses indicate payment terms when sending an invoice to their customers. The most common one is “Net 30”, which means that clients have up to 30 days to complete payment. It is important to clearly indicate your payment term on the invoice so clients can know when a payment is due.

How Zetl can Help

Here at Zetl, we help SMEs build their business by providing a variety of funding solutions which includes Accounts Receivable financing. We help you unlock working capital in less than 24 hours so you can focus on what truly matters— growing your business.

Why choose us?

We are fast and flexible. Get paid the same day after signing up. Repay at your own convenience after 30 days.

Fully digital. Complete everything online — submit documents through our web app, and all contracts are executed digitally.

Confidential. Your client never needs to know about Zetl. All financing is fully confidential.

No personal guarantees. We believe business risk should be kept separate from personal liability.

Do not let cash flow stop your growth. Sign up on our website now! — www.zetl.com